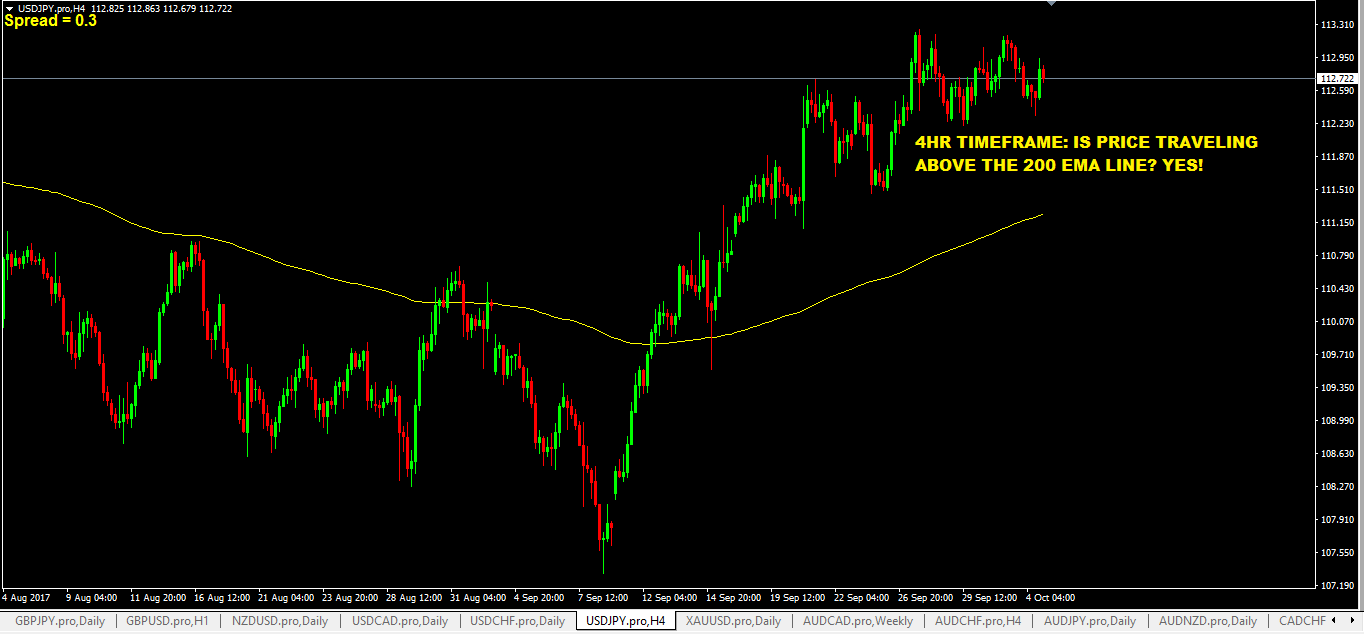

So, the main reason for using 3 moving averages is to know the situation of the various trends. The shortest period moving average in the system also indicates the price momentum and gives the trade signal when other conditions are right. The idea of using 3 moving averages of different periods to create a strategy is to get an idea of the different trends in the market: long-term, medium-term, and short-term trends. When only two moving averages are used, you can the golden cross and dead cross signals, which indicate the emergence of a bullish trend and a bearish trend respectively.

While one moving average can smooth out the overall price action and give us a good indication of the overall trend, using multiple moving averages helps to gauge the strength of the trends and also find trading opportunities. The longer-period EMAs indicate the trend, while the shorter-period EMAs are used to indicate the momentum of the price. Most times, EMAs of different periods are used for this. What is a moving average crossover strategy?Ī moving average crossover is a technical analysis method that uses two or more moving averages of different periods to analyze the trend and momentum of a market. In this post, we’ll discuss a 3 moving average crossover strategy, but first, let’s find out what a moving average crossover is. They are trend-following indicators and depending on the type of average that is calculated, they are classified into simple moving averages (SMA), exponential moving averages (EMA), linear-weighted moving averages (LWMA), and smoothed moving averages (SMMA).Īny of these moving average types can be used to create a crossover strategy, but traders often use the EMAs they focus more on the recent price data. Moving averages are indicators that measure the n-period mean of a particular price point, mostly the close price.

Last Updated on 20 April, 2023 by Samuelsson 3 moving average crossover strategy 1.4.3 Trading the trend continuation after a pullback

0 kommentar(er)

0 kommentar(er)